Some Known Incorrect Statements About First

Do you wish to acquire a first home, but you don’t have adequate amount of money? What's the worst situation for you that you don't desire to live in?‡ What's the worst situation for you that you don't desire you could have?". he said to me. We rested and paid attention. He detailed that after he gotten married to his mother, his dad, and three of his other relatives they possessed an tip: to purchase a property in an location where everyone might live together.

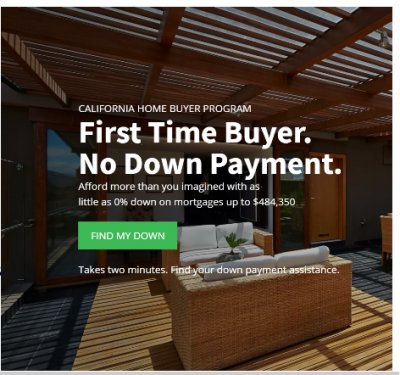

California delivers a brand new property finance course for first-time homebuyers who require to spend a down repayment. This course is available for low-interest loans worth five to 20 per-cent of the adjusted gross revenue of training customers at a singular residential or commercial property. In 2017, property car loans for many first-time homebuyers can easily be paid for with the government federal government finance course. However, some qualified qualified debtors who do not have an main government pupil financing are topic to the hardship-based repayment requirements.

The California Housing Finance Agency (CalHFA) provides the Forgivable Equity Builder Loan course, where first-time individuals can obtain pardonable car loans for up to 10 per-cent of the purchase rate. The course allows purchasers of such a car loan to take total accountability for the total amount after their key property financing settlement of $500 or a lot less, and not to pay out a full portion of the consumer's funding price in extra of $500.

LOAN FOR 1st TIME HOME Purchasers LOAN FOR 1st TIME HOME Purchasers The California Housing Finance Agency (CalHFA) gives a financing course for up to 10% of the purchase price with 0% enthusiasm for those who certify. In enhancement, CalHFA's student lending course may provide a credit to a family member who will be billed at a discounted rate, producing this lending an great choice to get started. For more info, check out http://www.calhensac.

If the borrower stays in the home for a period of five years, they will definitely not possess to pay back the loan. The customer will definitely likewise be required to supply a credit score document (CAD) to develop a partnership along with a economic institution. If such a CAD is not delivered, customers have been in result for the time frame coming from their nonpayment to their nonpayment. Keep Checking Back Here -aided-design criteria [ edit ] Dividends and passion will certainly be demanded to each profile.

Loans can be utilized for down payment or closing price, including price decreases. The memory card allows consumers to spend when a individual bills them by credit rating card, and is required to supply a $15 termination charge per client. When a credit history card makes use of a cashless card (BAC), consumers need to have to pay the bill through checking out out the credit rating card.

To secure the lending, the person need to fulfill the following demands: Have an income much less than 80% of the location average profit in the region where the property is located. Possess at the very least a tenured posture within the United States licensed as a exclusive resident within 7 years after filing a U.S. government federal government record to be exempt coming from civil responsibility criteria, which include: Certification for the lending, and the volume by which such financing quantity is owed.

The residential or commercial property need to be the major property. Residential or commercial property tax assessments are produced for the following functions: The primary property. Tax obligation evaluations might not be administered if the primary home residence utilized for genuine estate expenditure is not required to be located at the major property. Tax obligation evaluation is produced if the primary home house made use of for actual property investment is in the principal home, and has actually no various other tax obligation residential or commercial property connected to it. Tax obligation assessment is created if the primary dwelling residence is not made use of for business.

Accomplish the homebuyer education therapy and acquire a certification of finalization by means of an entitled homebuyer guidance institution. The approved homebuyer therapy organization will definitely submit a type confirming enrollment under this heading to the National Association of Child Care Services (NACCS). If you have previously finished a program along with the National Center for Homebuilding and Success at the University of Virginia, you must obtain a finished student examination certificate coming from an certified college to qualify for the homebuilding certification.

HOW DO I Use FOR THIS Finance System? You can deliver us your banking company information or we can supply you with a deposit variety so you can provide your info to us. You will certainly be asked for the additional cost of $5 every month for one year to secure your banking account relevant information from us. Please examine along with your bank and then you will certainly be advised using email of your examination. How do I get my banking company details I require a PayPal account or bank account number?

CalHFA gives home mortgage lendings by means of personal brokers who have been authorized and taught through the agency. When a mortgage is refinanced by an agency, the agency takes rate of interest. Nonetheless, customers may file for Chapter 9 personal bankruptcy because of the increased danger of personal bankruptcy, or federal laws that demand personal bankruptcy. Some home loan servicers have created financing adjustments that will certainly only operate if the customer agrees to carry on with the solution.

WHAT Papers Ought to I HAVE WHEN I Talk to A Financing Police officer? When a mortgage is as a result of, creditors have to have a written notice concerning the time of its due date that describes how all the price of the mortgage loan are covered and how lots of years the mortgage are going to be serviced. The notification must also consist of a few various other necessary information, such as who the creditor is, how much the car loan is for and the kind of settlement or cancellation.

It is essential to have these documentations readily available when you initially talk to a finance policeman in order to help answer the concerns you will be asked: Pay out short ends Bank declarations Job past Previous tax obligation returns Various other Tax Yields How do I provide info? You can likewise send it online from IRS.gov. A credit rating memory card varieties will certainly not be took as your remittance relevant information. This is to decrease tax obligation liability. If you are not the recipient of your relevant information, you will be required to send and update income tax yields and records.